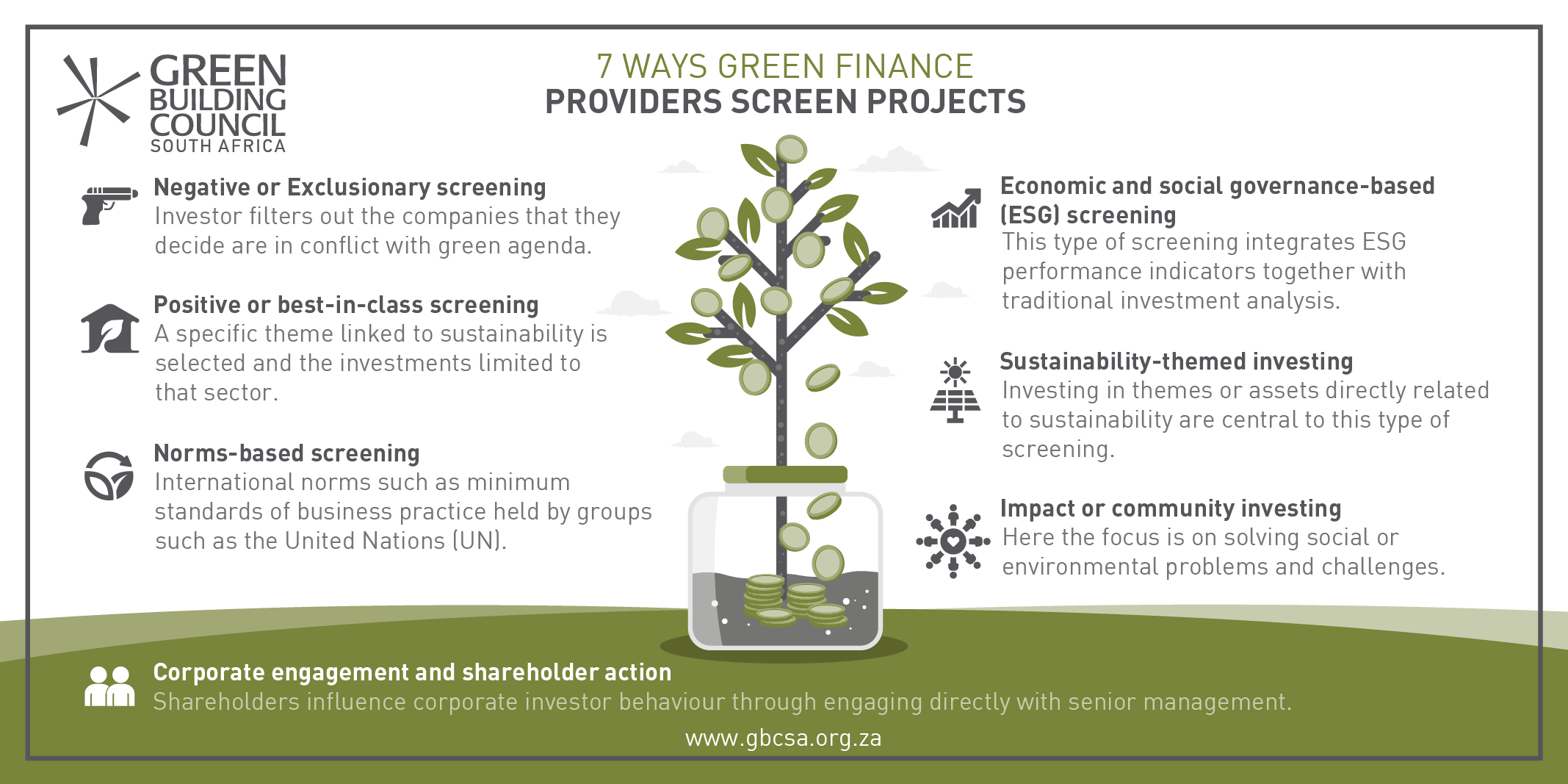

7 ways green finance providers screen projects

March 28, 2020

What decision-making filters do green finance providers use when deciding where to invest? In this post the Green Building Council South Africa (GBCSA) will unpack seven points taken from research by the Global Sustainable Investment Alliance.

Negative or Exclusionary screening

Here an investor intentionally filters out the companies and entities that they decide have a negative impact on society in general or conflict with environmental and social governance criteria. For example, this approach may exclude industries involved in tobacco, thermal coal (the type of coal used to generate electricity), weapons, or gambling.

Positive or best-in-class screening

Also known as thematic investing, here a specific theme linked to sustainability is selected, such as climate, housing, and water, and the investments limited to that sector. The investments are motivated either by the requirements to ensure the best financial return for financers, or by the need to align their portfolio with their specific values.

Norms-based screening

International norms such as minimum standards of business practice held by groups such as the United Nations (UN) and the Organisation for Economic Co-operation and Development (OECD). These minimum standards include factors bearing to human rights, labour conditions, environmental responsibility and anti-corruption.

Economic and social governance-based (ESG) screening

This type of screening integrates ESG performance indicators together with traditional investment analysis and decision making at the point of buying the asset. Sometimes investors use a ‘best-in-class’ within the ESG view to create specific scores relative to the overall market. This listing of ESG scores of other similar companies help to give a point of reference to decision makers.

Sustainability-themed investing

Investing in themes or assets directly related to sustainability are central to this type of screening, which will focus on sectors such as clean energy, green technologies, sustainable agriculture and the like.

Impact or community investing

Here the focus is on solving social or environmental problems and challenges, which may include community investing where investments are used to create capital, credit and training resources and opportunities for people who are under-served by traditional financial institutions. The target is to invest directly in social or environmental projects.

Corporate engagement and shareholder action

In this scenario shareholders influence corporate investor behaviour through engaging directly with senior management and possibly also the boards of companies, filing or co-filing shareholder proposals and proxy voting that is guided by ESG guidelines.

For more information on green finance, contact the GBCSA on [email protected].